Market Overview

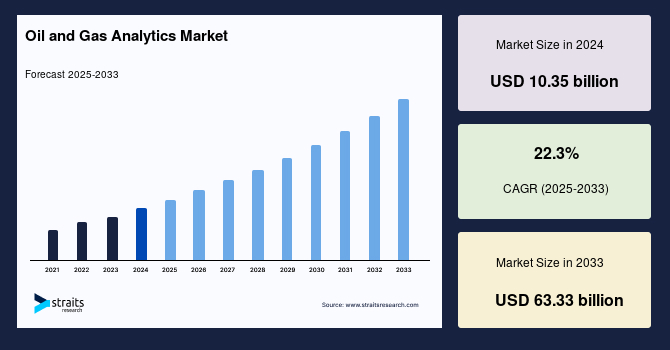

The global oil and gas analytics market size was valued at USD 8.46 billion in 2024. It is projected to reach from USD 10.34 billion in 2025 to USD 63.5 billion by 2033, at a CAGR of 22.3% during the forecast period (2025-2033). The escalating global need for energy significantly drives the industry.

The Role and Benefits of Analytics

Oil and gas analytics encompasses a suite of statistical and machine learning techniques leveraged for predictive analysis, operational optimization, and risk mitigation. By deploying these sophisticated methods, companies in the sector unearth vital trends and actionable patterns, enhancing decision quality, yield, and overall performance. An intrinsic value of these solutions lies in their impact: improved occupational safety, streamlined drilling operations, and efficient asset management, all contributing to accelerated growth for analytics adopters.

Key Drivers of Market Expansion

A triad of factors drives growth in this dynamic sector:

- Digital Transformation and Process Automation: Increasing investments in digitization and the adoption of automation in operational processes are at the forefront of market expansion. The imperative to derive value from extensive, often unstructured field data has compelled oil and gas businesses toward advanced analytics solutions.

- Security and Regulatory Compliance: Heightened emphasis on safety and regulatory frameworks from OSHA in the U.S. to PNGRB in India propels the need for robust analytics platforms. These tools are essential for monitoring compliance and reporting requirements, especially critical in contexts such as hydraulic fracturing and pipeline permitting.

- Environmental Monitoring and Risk Management: Persistent scrutiny over environmental issues such as air and water quality, chemical management, and emissions ensures that analytics platforms are integrated for improved reporting, preventive maintenance, and proactive operational adjustments.

Technological Evolution: AI, IoT, and Predictive Analytics

The last decade has witnessed a paradigm shift in oil and gas analytics, fueled by cutting-edge technologies:

- Machine Learning and Artificial Intelligence (AI): These tools underpin predictive maintenance models, drill bit failure analysis, and enterprise analytics applications. Algorithms now forecast equipment breakdowns with high accuracy, minimizing downtime and maximizing productivity.

- Internet of Things (IoT) and Sensor Networks: Real-time data collection from rigs, plants, and field assets has grown exponentially. Sensor-driven data feeds analytics models, enabling near-instantaneous decision-making, and facilitating predictive and preventative maintenance strategies.

- Cloud-based Platforms: The swift adoption of cloud services, especially in the Asia Pacific and Europe, streamlines data management, processing, and accessibility across globally dispersed operations.

Market Segmentation: Offerings and Applications

The oil and gas analytics market is segmented by offering (hardware, software, service), deployment, application, end-user, and region.

- Software Segment: Dominates due to the proliferation of ML and AI-based predictive analytics, IoT-driven data streams, and remote monitoring solutions. Production analytics and robotics are increasingly significant, driven by sensor network integration and business intelligence platforms.

- Hardware Segment: Fastest-growing, supported by investments in advanced sensor technologies and data acquisition systems, which drive operational efficiency and cost savings.

- Service Segment: Encompasses the secure storage, maintenance, and management of large-scale datasets, underpinning overall analytics infrastructure.

Regional Insights and Growth Patterns

- North America: Retains the largest market share, buoyed by the U.S.’s substantial oil and gas production, regulatory stringency, and rapid technological adoption. Notably, mergers like Enverus’s acquisition of RS Energy Group highlight the region’s innovation and scale.

- Asia Pacific: Expected to grow at a CAGR of 22.8%, driven by expanding oil exploration initiatives, increased investment, and rapid uptake of analytics platforms, especially in China and India.

- Europe: Shows pronounced growth, underpinned by digital transformation, regulatory mandates for reduced carbon footprints, and aging resource exploration demanding predictive consultancy.

Market Challenges

Despite optimistic forecasts, implementation barriers persist:

- Data Management and Transmission: Transmitting voluminous field data to processing centers is challenged by infrastructural limitations and protocol discrepancies.

- Talent Shortage: There remains a deficit of analytics-skilled professionals, hindering full-scale adoption and development.

- Cost and Infrastructure: The financial burden associated with data recording, storage, and the purchase of advanced analytics tools restricts smaller enterprises from entering the space.

Future Outlook and Opportunities

With natural gas extraction and unconventional resources (like shale) rapidly growing, real-time analytics will be indispensable for operational optimization. AI and machine learning will deepen predictive insight and risk mitigation, opening new opportunities for analytics adoption. The global pivot toward digitization and regulatory compliance continues to accelerate the value delivered by analytics providers.