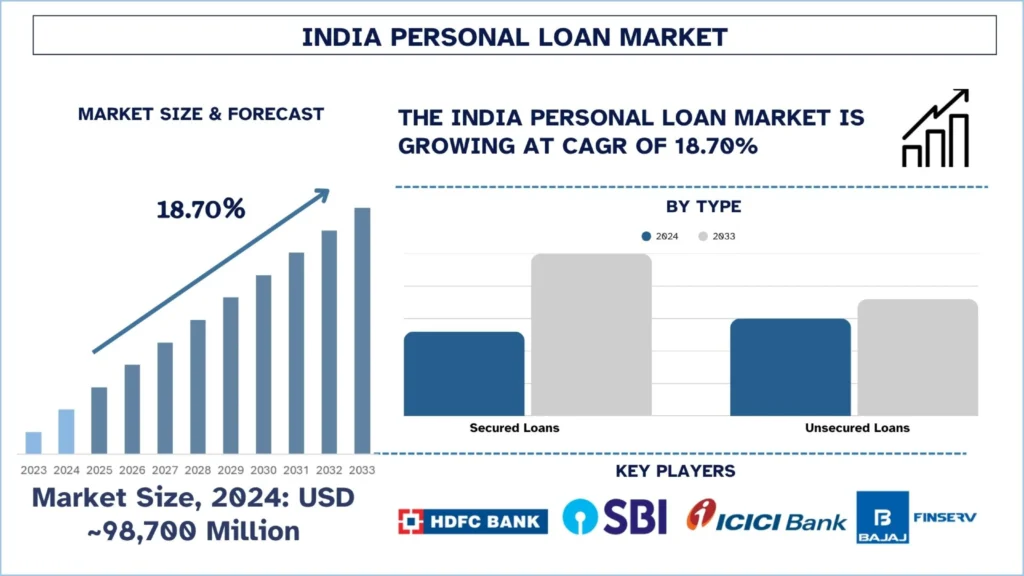

The India Personal Loan Market was valued at USD ~98,700 million in 2024 and is expected to grow to a strong CAGR of around 18.70% during the forecast period 2025-2033

India’s personal loan market is growing very rapidly, fueled by increasing demand from consumers, rising digital adoption, and changing financial behavior. Key players are using technology and customer–centric models to expand their footprints, but competition is heating up. Moreover, the established banks are transitioning to agile fintechs, molding the lending landscape. The article highlights the top players in the Indian personal loan sector that are moving towards enabling innovation and accessibility. The five important players involved are as follows:

HDFC Bank Ltd.

HDFC Bank Limited engages in the provision of banking and financial services to individuals and businesses in India, Bahrain, Hong Kong, Singapore, and Dubai. The company operates in three segments: Treasury, Retail Banking, Wholesale Banking, and Other Banking Services. It accepts savings, salary, current, rural, public provident fund, pension, and demat accounts; fixed and recurring deposits; and safe deposit lockers, as well as offshore accounts and deposits, and overdrafts against fixed deposits. The company also provides personal, home, car, two-wheeler, business, doctor, educational, gold, consumer, and rural loans; loans against properties, securities, mutual funds, rental receivables, and assets; loans for professionals; government sponsored programs; and loans on credit card, as well as working capital and commercial/construction equipment finance, healthcare/medical equipment and commercial vehicle finance, dealer finance, and term loans. Further, the company provides short term finance, bill discounting, structured finance, export credit, loan repayment, and documents collection services; online and wholesale, mobile, and phone banking services; unified payment interface, immediate payment, national electronic funds transfer, and real time gross settlement services; and channel financing, vendor financing, reimbursement account, money market, derivatives, etc. It operates branches and automated teller machines in various cities/towns. The company was incorporated in 1994 and is headquartered in Mumbai, India.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/india-personal-loan-market?popup=report-enquiry

State Bank of India

State Bank of India provides banking products and services in India and internationally. It operates through the Treasury, Corporate/Wholesale Banking, Retail Banking, and Other Banking Business segments. The company offers personal banking products and services, including current, savings, salary, and deposit accounts; home, personal, pension, auto, education, and gold loans, as well as loans against insurance policies, property, and securities; debit, business debit, prepaid, and green remit cards; overdrafts; mutual funds, insurance, equity trading, portfolio investment schemes, remittance services; digital lending; and mobile, internet, and digital banking services. It also provides corporate banking products and services comprising corporate accounts, working capital and project finance, deferred payment guarantees, corporate term loans, structured finance, dealer and channel financing, equipment leasing, loan syndication, construction equipment loans, financing Indian firms’ overseas subsidiaries or JVs, and cash management, as well as trade and service products. In addition, the company offers NRI services, including accounts, investments, loans, and remittances; agricultural banking services; and international banking services. Further, it provides life and general insurance, estate planning services, merchant banking and advisory, securities broking, trusteeship service, factoring, payment solutions, asset management, investment management, credit cards, and custody and fund accounting services. The State Bank of India was founded in 1806 and is headquartered in Mumbai, India.

ICICI Bank

ICICI Bank Limited, together with its subsidiaries, engages in the provision of various banking and financial services to retail and corporate customers in India and internationally. The company operates through Retail Banking, Wholesale Banking, Treasury, Other Banking, Life Insurance, and Other segments. It accepts savings, salary, pension, current, trade, escrow, foreign currency, and vostro accounts, as well as time, fixed, recurring, and security deposit services. The company also provides home, car, two-wheeler, personal, gold, and commercial business loans, as well as loans against securities and other loans; business loans, including working capital finance, term loans, collateral free loans, loans without financials, finance for importers and exporters, and overdraft facilities, as well as loans for new entities and card swipes; and credit, debit, prepaid, travel, forex, and corporate cards. In addition, it offers a pocket wallet, fixed income products, investment products, such as mutual funds, gold monetization schemes, initial public offerings, and other online investment services; and agri and rural business, farmer finance, tractor loans, and micro banking services. Further, the company provides portfolio management, trade, foreign exchange, locker, private and NRI banking, and cash management services; family wealth and demat accounts; commercial and investment banking, capital market, custodial, and institutional banking services; health, personal accident, fire, and motor insurance, as well as distributes general and life insurance products; and Internet, mobile, and phone banking services. Additionally, it offers securities investment, broking, trading, and underwriting services; and merchant banking, trusteeship, housing finance, pension fund management, asset management, investment advisory, points of presence, and private equity/venture capital fund management services. The company was founded in 1955 and is headquartered in Mumbai, India.

Click here to view the Report Description & TOC: https://univdatos.com/reports/india-personal-loan-market

Axis Bank

Axis Bank Limited, together with its subsidiaries, engages in the provision of various banking and financial products and services. It operates through four segments: Treasury, Retail Banking, Corporate/Wholesale Banking, and Other Banking Business. The Treasury segment is involved in investments in sovereign and corporate debt, equity and mutual funds, as well as in trading operations, derivative trading, and foreign exchange operations. The Retail Banking segment engages in the provision of lending services to individuals/small businesses; liability products; card services, including credit, debit, and forex cards; internet banking, mobile banking, and ATM services; retail term deposits; financial advisory services; NRI and digital banking services; bill payment and wealth management services; and distribution of third-party product, such as life and non-life insurance, mutual funds, government bonds, etc. The Corporate/Wholesale Banking segment offers business lending, corporate advisory, placements and syndication, project appraisals, current and corporate term deposits, payments, trade finance products, letter of credits, bank guarantees, commercial cards, cash management, project appraisals, and capital market-related services. It also has international offices with branches in Singapore and Dubai, and representative offices in Dhaka, Dubai, Abu Dhabi, and Sharjah. The company was formerly known as UTI Bank Limited and changed its name to Axis Bank Limited in July 2007. Axis Bank Limited was incorporated in 1993 and is headquartered in Mumbai, India.

Bajaj Finance Limited

Bajaj Finance Limited operates as a deposit-taking non-banking financial company in India. The company offers consumer finance products comprising durable, lifestyle, and digital products; EMI cards; two and three-wheeler, and personal loans; loans against fixed deposit; home and gold loans; and extended warranties, retail EMIs, consumer electronics, furniture, e-commerce, and co-branded credit cards and wallets. It also provides secured and unsecured loans to micro, small, and medium enterprises (MSMEs) and SMEs; loans against property, mutual funds, insurance policies, and shares; lease rental discounting, business and professional loans, working capital loans, and term loans; developer finance; and new and used car, and tractor financing. In addition, the company offers commercial and rural lending, public and corporate deposits, loans against securities, and various investment services, including demat services, broking, and margin trade financing. Further, it distributes life, health, and general insurance products. The company was formerly known as Bajaj Auto Finance Limited and changed its name to Bajaj Finance Limited in September 2010. The company was incorporated in 1987 and is based in Pune, India. Bajaj Finance Limited is a subsidiary of Bajaj Finserv Ltd.

According to the UnivDatos, the rising urbanization and middle-class expansion, digitization of lending services, increase in consumer spending, simplified KYC and credit assessment, growth in Tier II and Tier III cities, expanding credit access to millennials and Gen Z, rising penetration of NBFCs and FinTechs drive the India Personal Loan market.

Contact Us:

UnivDatos

Email: contact@univdatos.com

Contact no: +1 978 7330253

Website: www.univdatos.com