Introduction

Food fortification, the process of adding essential micronutrients such as vitamins, minerals, and proteins to food products, has become a cornerstone in the fight against global malnutrition and vitamin deficiencies. As nutrition-related concerns and chronic health conditions persist worldwide, the food fortification industry stands at the forefront of solutions to improve public well-being and advance sustainable health outcomes.

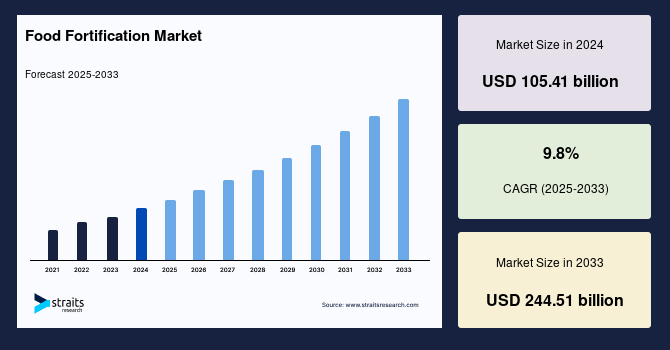

Market Size and Growth Outlook

The global food fortification market size was valued at USD 105.41 billion in 2024 and is projected to reach from USD 115.74 billion in 2025 to USD 244.51 billion by 2033, registering a CAGR of 9.8% during the forecast period (2025-2033). The increasing consumer awareness regarding fortified food and its associated health advantages is expected to act as a catalyst.

Key Growth Drivers

Escalating Malnutrition and Health Issues

Persistent malnutrition and vitamin deficiencies are critical challenges affecting millions globally. Recent reports show that 149 million children under five suffer from stunted growth, and 148.1 million (22.3% of the population) experienced stunting in 2021. Additionally, 45 million children, or 6.8%, were documented as suffering from wasting. These indicators point to a continuing need to enrich everyday food supplies to tackle ‘hidden hunger’ and assure healthy development in vulnerable populations.

Increasing Awareness and Demand for Improved Nutrition

A notable shift in consumer preferences is accelerating the popularity of fortified foods and beverages. Heightened knowledge about nutrition, chronic diseases, and the importance of micro- and macronutrients is motivating individuals and families to proactively choose products offering added health benefits. Governments and the private sector have responded to this demand, resulting in stronger partnerships, widespread fortification initiatives, and education campaigns promoting healthy eating choices.

Technological Innovations and Biofortification

Advances in fortification technologies have made it possible to enrich a broad array of foods, ranging from cereals and dairy to ready-to-eat and frozen meals, without compromising taste or shelf stability. The emergence of biofortification—enhancing essential nutrients directly in staple crops through agricultural practices—has greatly expanded accessibility in regions with high instances of micronutrient deficiencies. Programs such as the Commercialisation of Biofortified Crops (CBC) and initiatives by organizations like HarvestPlus have led to the introduction of over 130 biofortified varieties in 30 countries, scaling up nutritional benefits and reach.

Regional Insights

North America

North America dominates the global food fortification market, supported by a health-conscious population and robust government measures targeting vitamin deficiencies. The region’s market is expected to grow at a CAGR of 9.2%, with policy resolutions calling for expanded fortification and supplementation to meet WHO and United Nations nutrition targets. Efforts focus on fortified dairy products, cereals, and functional foods.

Asia-Pacific

With diverse dietary patterns and a huge population base, Asia-Pacific is projected to expand at a 9.5% CAGR. Governments and organizations actively target vitamin deficiencies in staple foods and explore innovative approaches to traditional dietary habits. The region has witnessed significant progress via biofortification and nutritional education programs, which boost demand for fortified products ranging from staples to convenience foods.

Europe

Europe holds a substantial market share, driven by interest in natural, clean-label fortification and plant-based alternatives. Historical success in combating nutritional deficiency diseases through the fortification of salt and dairy products has evolved into current trends favoring organic, non-GMO fortification and functional foods. The impact of fortified foods, specifically vitamin D, has contributed to lower mortality rates from certain diseases, supporting sustained market growth.

Product Segmentation and Innovations

Dairy and Dairy-Based Products

Dairy fortification is prevalent, reflecting the widespread inclusion of calcium and vitamin D in milk, yogurt, and dairy alternatives. These products support bone health and overall wellness, catering to consumers seeking functional nutrition benefits.

Infant Formula

The infant formula segment is forecasted as the fastest growing, fueled by innovations such as the addition of omega-3 fatty acids, prebiotics, and advanced vitamins. Enhanced formulas are developed to replicate the composition and benefits of breast milk, addressing cognitive and immune development needs.

Nutrient Segments

The minerals segment leads the market, responding to the global burden of iron and other micronutrient deficiencies. Protein fortification is rapidly advancing, catering to growing segments focused on fitness, vegetarian diets, and weight management. Vitamin fortification remains integral, addressing needs for nutrients like A, D, and B complex to support immunity and general health.

Convenience and Frozen Foods

Ready-to-eat and frozen foods represent a major trend in food fortification, aligning with the demands of urban, fast-paced lifestyles. The addition of critical nutrients to these categories makes balanced diets more accessible, supporting public health objectives and broadening reach.

Challenges and Opportunities

Although the market’s prospects are positive, food fortification presents unique challenges. Costs associated with ingredient procurement, technology, and quality assurance can impact accessibility, particularly in low-income regions. Additionally, preserving nutrient stability and bioavailability throughout shelf life requires continuous research and innovation.

Government intervention and collaborative action among public and private entities are essential for overcoming barriers. Investments in affordable and sustainable fortification methods will support market expansion and ensure greater health impact across populations.

Conclusion

The food fortification market is set for significant growth as health priorities shift and awareness around nutrition continues to rise globally. Driven by malnutrition challenges, consumer demand, and innovation, the industry presents unique opportunities for stakeholders to contribute to combating nutritional deficiencies, improving overall wellness, and fulfilling long-term global health goals.