IMARC Group, a leading market research company, has recently released a report titled “Air Traffic Management Market Size, Share, Trends and Forecast by Domain, Component, Application, End User, and Region, 2025-2033.” The study provides a detailed analysis of the industry, including the global air traffic management market share, size, trends, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Air Traffic Management Market Highlights:

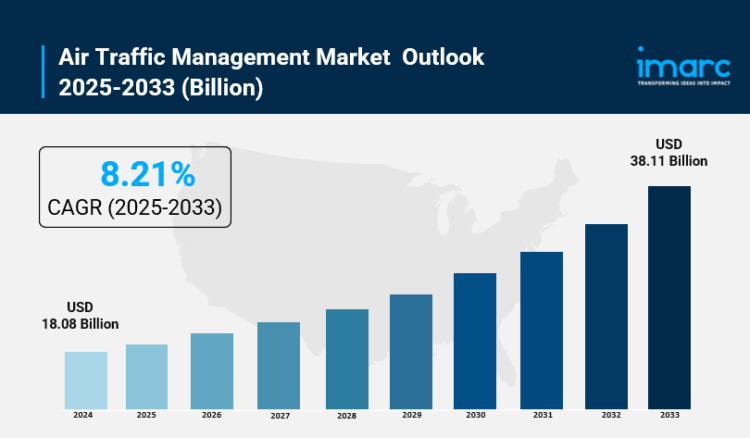

- Air Traffic Management Market Size: Valued at USD 18.08 Billion in 2024.

- Air Traffic Management Market Forecast: The market is projected to reach USD 38.11 billion by 2033.

- Market Growth: The air traffic management market is experiencing robust expansion driven by surging global air travel demand and massive infrastructure modernization initiatives.

- Technology Integration: Advanced technologies including AI-powered analytics, satellite-based surveillance systems, and real-time data sharing platforms are transforming how airspace is managed worldwide.

- Regional Leadership: Asia-Pacific dominates the market with a commanding 33.7% share in 2024, propelled by rapid economic growth and extensive airport development programs.

- Safety Enhancement: Rising concerns about airspace congestion and security are pushing airports and aviation authorities to invest heavily in next-generation ATM technologies.

- Key Players: Industry leaders include Thales Group, Honeywell International Inc., L3Harris Technologies Inc., Indra Sistemas S.A., and Leonardo S.p.A., which are setting new standards with innovative solutions.

- Market Challenges: Integration with legacy infrastructure and the urgent need for skilled air traffic controllers present ongoing challenges for the industry.

Claim Your Free “Air Traffic Management Market” Insights Sample PDF: https://www.imarcgroup.com/air-traffic-management-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Industry Trends and Drivers:

- Unprecedented Growth in Global Air Travel:

A passenger traffic boom, leading to a revolution in airspace management, is occurring across the aviation sector. According to the International Air Transport Association (IATA), global passenger air traffic reached an all-time high during 2024 with an increase of more than 10% compared to the previous year. In 2024, 876 million passengers flew each year in the US. In China, since 2019, the 625 million annual passengers have grown to 741 million in 2024, an 18.7% increase in five years, with the country’s ATC capabilities reaching their limits and capacity bottlenecks forming. The Bureau of Transportation Statistics reported that 70.7 million airline passengers were carried by United States airlines in January 2025. The issue of meeting airline demand is not only the passenger numbers, but the supply chain is causing a delay in new capacity being delivered to airlines. As a result, the growth of supply failed to keep pace with the growth of demand. Consequently, aerodromes and national aviation authorities have invested in new ATM systems, allowing an increase in traffic without compromising safety.

- Revolutionary Technology Integration Reshaping Operations:

As air traffic management (ATM) authorities around the world embrace new technologies which will transform ATM services, Thales signed a frame agreement with Sopra Steria in February 2025 which makes Sopra Steria the lead contractor for the digital transformation of the European ATM sector, deploying the Thales OpenSky Platform and sustainable aviation support. That same month, DataBeacon also announced Tango5, an interactive schoolroom instructional software application designed for air traffic management students and trainees using the method of learning by doing. In May 2025, Aireon and Thales announced a partnership to improve air traffic flow management. Aireon will provide AireonFLOW data streams to partners via Thales’ TopSky – Flow Manager, developing next-gen solutions to reduce congestion and deliver greater predictability. The transition to satellite-driven surveillance and decision support systems powered by artificial intelligence (AI) and cloud technology is accelerating. The FAA’s NextGen program has already delivered net benefits worth USD 12.4 billion, and is on pace to deliver USD 36 billion in net benefits by 2040. Nextgen enrolls smart systems to provide air traffic controllers with more situational awareness enabling controllers to deliver more precise and informed directions for more complex airspaces.

- Massive Government-Backed Infrastructure Modernization:

Governments and aviation authorities are investing billions of dollars into developing the ATM for the future. The FAA continues implementation of its multi-decade NextGen program which includes the introduction of satellite based navigation, digital communications and automated decision support tools to enable greater use of the airspace and reduce delays and fuel use. The FAA had initially projected that all major systems would be in place by 2025. The FAA now expects all major NextGen systems to be in place by 2030. The SESAR Joint Undertaking’s ATM Master Plan 2025 sets out 10 key priorities which mostly concern data and sustainable operations in European airspace. According to industry estimates, 285 of the FAA’s 313 air traffic facilities are below target staffing levels. Technology purchases for the system are being accelerated due to immediate capacity limitations. In Nov 2024, Indra acquired UK-based Micro Nav, an air traffic control (ATC) and air defence simulation technology company, and Global ATS, a provider of specialist training services. The acquisition improved Indra’s ability to respond to increasing demand in the UK, Middle East and Asia-Pacific for ATC simulating and training products and services, in international recognition that current ATM infrastructure will not support the projected growth in air traffic in coming decades.

- Enhanced Safety Requirements Driving Innovation:

ATM is driven by global safety concerns and the complexity of airspace operations. Aviation-related cyberattacks across the industry surged by 131% between 2022 and 2023. This trend is being attributed to the use of cloud computing and interconnectivity. The European Union Aviation Safety Agency plans to develop Part-IS regulations to ensure that cyber-risk management is integrated into air traffic management safety regulations in 2025. This is a new challenge presented by the operation of unmanned aircraft systems in the national airspace system. This led to the development of Unmanned Traffic Management systems by many countries for safe drone operations integration with manned aircraft. In June of 2023, Indra Sistemas released its new generation of air traffic management (ATM) systems, which contained AI capabilities to automate various tasks. Through processing data via AI, industry professionals can optimize procedures and improve safety and efficiency. For example, AI helps to find the most optimized flight route and reduce delays. Additionally, the goal is not only to reduce harm, but also to design systems which are resilient to weather effects, technical problems or other events which affect passengers.

Air Traffic Management Market Report Segmentation:

Breakup by Domain:

- Air Traffic Control

- Air Traffic Flow Management

- Aeronautical Information Management

Air Traffic Control dominates with 35.7% market share, reflecting its essential function in maintaining the safety, efficiency, and seamless management of air traffic as flight volumes continue rising globally.

Breakup by Component:

- Hardware

- Software

Hardware commands the majority market share, driven by mandated upgrades to radar systems, digital radios, and surveillance sensors, though software is experiencing the fastest growth due to AI decision-support and cloud-based analytics.

Breakup by Application:

- Communication

- Navigation

- Surveillance

- Automation

Communication systems lead the application segment, accounting for the largest share due to increasing need for real-time data exchange and enhanced communication between aircraft and ground control through digital data link technologies.

Breakup by End User:

- Commercial

- Military

Commercial aviation dominates with the largest market share, driven by the post-pandemic rebound in passenger traffic and sustainability regulations that intensify airspace-efficiency requirements.

Breakup by Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific leads the market with a 33.7% share in 2024, attributed to swift economic development, rising middle-class populations, notable urban growth, and substantial government investments in sophisticated ATM systems to handle escalating air traffic.

Who are the key players operating in the industry?

The report covers the major market players including:

- Adacel Technologies Limited

- Advanced Navigation and Positioning Corporation

- Airbus SE

- Honeywell International Inc.

- Indra Sistemas S.A.

- L3Harris Technologies Inc.

- Leidos

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Saab AB

- Thales Group

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=4656&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302